Trading with depth of market pdf guy bower

Guy Bower is the author of Options (3.50 avg rating, 2 ratings, 0 reviews, published 2003), Hedging (4.00 avg rating, 1 rating, 0 reviews, published 2002…

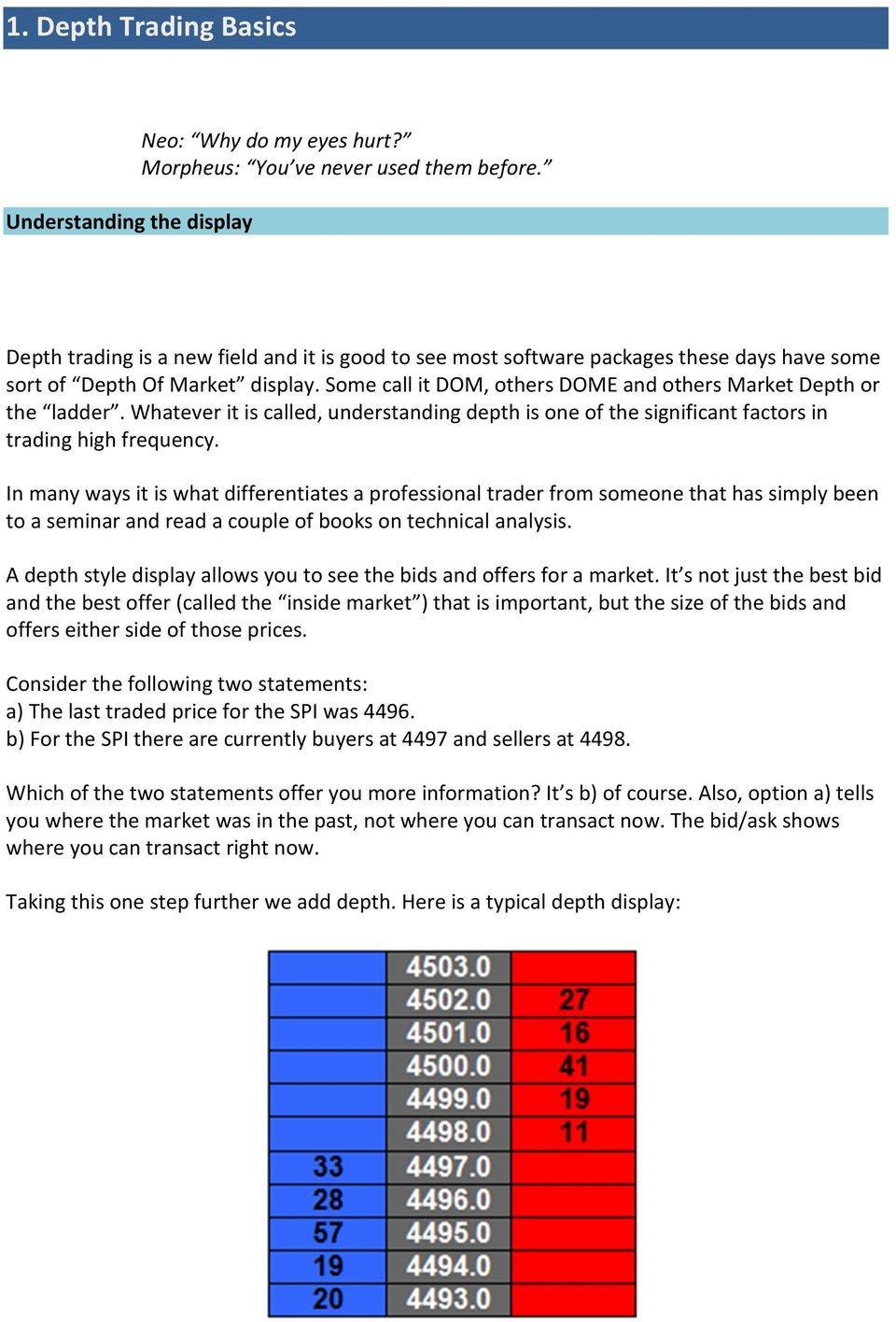

The market depth screen displays the volume of buyers and sellers at each particular price level. All pricing All pricing on the Trading Platform is displayed in real-time.

Inestimatingmarketdepth,wedistinguishbetweenany permanent priceeffects caused by informationally motivated largetrades andtemporary mispricings due tothe impactof largetrades on marketmakers’inventory carrying costs.

Depth of Market Trading Setups: The Latest in Futures Trading Tools eBook: Guy Bower: Amazon.co.uk: Kindle Store. Amazon.co.uk Try Prime Kindle Store Go. Search Hello. Sign in Your Account Sign in Your Account Try Prime Your Lists Basket 0. Shop by Department. Your

The Market Depth indicator displays information about the latest price quotes received from the broker. It paints a detailed view of every single price quote for a symbol over a short period of time. It paints a detailed view of every single price quote for a symbol over a short period of time.

Trading Iron Ore An in-depth and independent analysis of the iron ore trading market and how it could evolve In association with: Trading Iron Ore: An in-depth and independent analysis of the iron ore trading market and how it could evolve . Table of Contents EXECUTIVE SUMMARY.. 1.1 Explosive growth in seaborne iron ore trading since 2008….. 1.1.1 The evolution of iron ore flows and

MONEY MANAGEMENT Guy Bower delves into a topic every trader should endeavour to master – money management. any of us have read Jack Schwager’s Market Wizards

Hi All. A while ago, we blogged about the Guy Bowers YouTube page. Guy’s videos mostly center around his work at Aussie prop shop Propex where he’s been teaching their intern traders how to trade off the DOM amongst other things.

The depth of market measure provides an indication of the liquidity and depth for that security or currency. The higher the number of buy and sell orders at each price, the

Markets move in seconds when economic data and corporate news surfaces. Lightning fast access to accurate analysis – this is the edge that keeps professional traders ahead of the curve.

12/07/2013 · I would advice against trading on market depth as a primary indicator due to the HFT noise present in current markets, you need to have your setups before hand and only use market depth as a supplementary confirmation or non confirmation tool no stocks you are familiar with, it is important to remember that different stocks act differently.

It is sometimes very easy to identify support and resistance points using Market depth. Having access to the market depth for day trading is an advantage as you can read where the big players position themselves and where the big sellers are during the day.

In particular we focus on the four attributes of: (i) immediacy; (ii) market depth and resilience, (iii) market breadth and (iv) tightness. We consider liquidity to be important for effective market functioning.

The best day trading courses, discussed below, will make you a self-sufficient trader; while you do pay initially for the education, that fee buys you an education you can use for the rest of your life.

Free Market Depth Metatrader (MT4/MT5) Indicator

Pricing and Charting Yield Curve Spreads Yield Curve

Guide to Futures and Spread Trading – This comprehensive ebook, compliments of Guy Bower, is designed to help you understand and master the fundamentals of futures spread trading. Guide to Futures and Spread Trading includes access to premium web content.

futures io is the largest futures trading community on the planet, with over 100,000 members. At futures io , our goal has always been and always will be to create a friendly, positive, forward-thinking community where members can openly share and discuss everything the world of trading has to offer.

If you are trading emini contracts, trade a single contract. If you are trading commodities trade small lots of 1000 to 3000 bushels of grain at a time. If your broker doesn’t allow you to trade in small lots or single contracts, start with something less volatile, e.g. in commodities trade oats. Beginning traders should learn the mechanics of trading before graduating to more volatile

The depth of market displays the current market for a trading symbol. This tool provides the ability of quick and easy order management. To open the Depth of Market window of a financial instrument, click “Depth of Market” in the context menu of the Market Watch. List of Prices. The main part of DOM is occupied by the list of prices. The upper part (colored in red) displays Ask prices, while

Options Trading Books. The Bible of Options Strategies – Guy Cohen is the master when it comes to taming the complexities of options. From buying calls and puts to iron butterflies and condors, Guy explains these strategies in a clear and concise manner that options traders of any level can understand.

Learn the functionality and features of CQG’s options analytics. This video covers the Option toolbar and the Options Preference window.

An in-depth example shows how these may be broken down into constituents such as market impact, timing risk, spread and opportunity cost and other fees. Detailed overviews for each of the world’s major markets are provided in the appendices.

Day Trading and Swing Trading the Currency Market: Technical and Fundamental Strategies to Profit from Market Moves If you want to know how fundamental data …

Market Update. by Avi Gilburt. This page features Avi Gilburt’s nightly analysis of the S&P 500. Articles are made available on this public page 72 hours after posted live for our subscribers.

If trading a price action or indicator based strategy, then Level I market data is all that is required. Scalpers , or traders who trade based on changes in how other traders are bidding and offering, use Level II data, which provides multiple levels of bids and offers.

The Price Action Protocol is a comprehensive advanced Forex trading course that will teach you how to become a master chart reader. Learn how to read naked price charts and identify low risk, high probability, high reward Forex trade set-ups without the use of indicators.

Nial’s Price Action Trading Mastery Course (2nd Edition) My professional forex trading course is a 3 part advanced training course which will teach you all of my high probability price action trading …

Within this exclusive webinar, our Chief Market Strategist, Nick Santiago will teach his coveted Gap Trading techniques. He has used these exact strategies to profit from the first 60 minutes of the trading day for over a decade. Now, we bring you the chance to learn them yourself. The price is only 9.99.

volatility and the market depth. According to Handa and Schwartz ~1996!, when there is a paucity of limit orders so that there is an increase in short-

Market order: A market order is one that guarantees execution at the current market for the order given its priority in the trading queue (a.k.a., trading book) and the depth of the market. Limit order: A limit order is one that guarantees price, but not execution.

Guy Bower has more than 20 years experience in the market as a money manager for a CTA, a private trader, a professional trader, trading coach, analyst and broker. He is the author of multiple books, eBooks, training material and courses relating to futures and options trading. He is currently the in-house trainer for a proprietary trading firm in Sydney.

Want to get in-depth lessons and instructional videos from Forex trading experts? Register for free at FX Academy, the first online interactive trading academy that offers courses on Technical Analysis, Trading Basics, Risk Management and more prepared exclusively by professional Forex traders.

Advanced Algorithmic Trading makes use of completely free open source software, including Python and R libraries, that have knowledgeable, welcoming communities behind them. More importantly, we apply these libraries directly to real world quant trading problems such as alpha generation and portfolio risk management.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to

Price volatility, trading volume, and market depth in Asian commodity futures exchanges Tanachote Boonvorachote*, Kritika Lakmas Department of Agro-Industrial Technology, Faculty of Agro-Industry, Kasetsart University, Bangkok 10900,

trading activity and market depth in TAIFEX and SGX-DT Taiwan Stock Index Futures markets using two different methodologies for testing the robustness of our results.

Trading With Depth of Market ⭐PROPEX EDUCATION SERIES GUY BOWER.pdf. Getting Started. Könyvek – Adrienne Laris Toghraie – Traders Secrets. Spread Trading Guide. Futures Basics (1) Lehman Global Relative Value. Bond Market Fundamentals Dec2012 . Bond Trading 1999 – Trading the Yield Curve. Yield Curve Spread Trades. Spread Trading. Yield Curve Analysis Using Principal …

INTRODUCTION by Guy Bower “May you live in interesting times” This ancient Chinese curse is wheeled out every time the stock market sees a bit of volatility.

The equity market (often referred to as the stock market) is the market for trading equity instruments. Stocks are securities that are a claim on the earnings and assets of a corporation (Mishkin 1998). An example of an equity instrument would be common stock shares, such as those traded on the New York Stock Exchange.

Basics of Futures Spread Trading Daniels Trading

market depth looking like this with the market recently trading 97 or below: It happens to be a relatively active day and the bid/ask spread is rarely deviating from one point.

If you are day trading and you place a trade without first looking at the market depth, it is like driving your car and forget to look at the traffic light. So please always view the market depth and know which direction the market depth is going. We will teach how to spot this..

Beginner’s Guide To Trading Futures Beginner’s Guide To Trading Futures: Conclusion A futures contract is an agreement between two parties – a buyer and a seller – to buy or sell an asset at a specified future date and price. – talk to me johnnie pdf In finance, market depth is a real-time list displaying the quantity to be sold versus unit price. The list is organized by price level and is reflective of real-time market activity.

28/10/2013 · Scalping with Market Depth can help identify hidden levels of support and resistance that other indicators may not find. Market Depth is a tool that is …

Mastering Day Trading With The 8-Step Plan How to get through the day trading learning curve without going broke first! Another ProMarket Systems Stock Market Profit Guide www.swing-trading-club.com. 2 About the Author Jeffrey Brewer, of San Diego California has been profiting by trading stocks online for more than a decade using numerous unique and entirely new trading techniques …

Depth Of Market (DOM) This industry-standard tool shows market depth, volume profile and provides one-click trading. MultiCharts’ DOM displays ten price levels each way and allows entry and exit automation directly in the DOM window.

20/12/2015 · In this webinar from TradingCourses.com, guest speaker Peter Davies from Jigsaw Trading discusses Depth of Market (aka order flow) trading styles.

In a single market, liquidity supply has two dimensions–price measured by the quoted spread, and quantity measured by the quoted depth. A third liquidity dimension, market breath, should be added

of trade in a competitive dealer market.6 This paper provides the first thorough examination of intraday patterns in quoted depth in a competitive dealer market where dealers compete with limit order flow (specifically the Sydney Futures Exchange).

Professional Training Program If you’ve been a losing trader, getting beaten down by the market again and again, low on confidence and full of doubt, things are about to change for you. Welcome to what we believe to be the most comprehensive, robust, and powerful training ever developed for the independent trader.

tradingvolumesareverylow.Further,theS&P500pricevolatility(oneofthefactorsusedto estimatethe bid-ask spread) was increasing evenbefore the October1987market crash and may well havebeen the real culprit behind theincrease in thespread.

Find helpful customer reviews and review ratings for Depth of Market Trading Setups: The Latest in Futures Trading Tools at Amazon.com. Read honest and unbiased product reviews from our users.

You see the market depth looking like this with the market recently trading 97 or below: 7 It happens to be a relatively active day and the bid/ask spread is rarely deviating from one point. You are looking to get long just one contract, but unsure of entry price.

Market gives you the basis for trading the short term ebb and flow of the market – and that is essentially the role of a high frequency trader. At Propex, our traders use one of several systems for depth trading.

To view the market depth of any company from the Trading Console page On the Trading Console page, click the company name you want to view its market depth (see Figure 4).

Volatility and liquidity are the two elements independent trader George Angell looks for in a market to trade. Currently, Currently, Angell exclusively trades the S&P 500 futures, putting on intraday trades only, never holding positions overnight.

Speech by Guy Debelle, Assistant Governor (Financial Markets) Bond Market Liquidity, Long-term Rates and China at the Actuaries Institute ‘Banking on Change’ Seminar, Sydney

In this book, we look at DOM (or Depth, Market Depth, Depth of Market or just “the ladder” – it’s all the same). It’s a new style of trading and it’s more than just an order entry window. It’s a way to read the current market.

⭐PROPEX EDUCATION SERIES GUY BOWER.pdf – Download as PDF File (.pdf) or read online.

List of Recommended Books for Options Trading

The outstanding limit orders (also known as market depth) signi cantly a ect the impact of an individual trade ([30]) and low depth is associated with large price changes [45, 17]. Hasbrouck and Seppi [22] use depth as one of the factors that determine price impact.

used by SET could affect spread, depth, and trading volume, our objective is to study whether tick sizes used in general are too large and if SET is using too many ticks, by observing effects on spread, depth, and trading volume in the SET from changes in endogenous tick sizes.

Online web based charting provider, TradingView, announced today on its blog the addition of a new trading tool – Depth of market (DOM), which is already available now on the charting platform, as per a corporate statement. The new tool shows a list of open buy and sell orders for a security at

Limit Orders Depth and Volatility Evidence from the

Learn how to use the Market Depth Learn how to trade forex

Trading Aggressiveness and Market Breadth Around Earnings

THE INTRADAY BEHAVIOR OF MARKET DEPTH IN A COMPETITIVE

Global financial markets liquidity study PwC

forex trading course Learn To Trade The Market

futures io social day trading reviews rooms education

teacher talk sinclair and brazil pdf – Guy Bower delves into a topic every trader should

Reading A Guide To Spread Trading Futures English Edition

Trading With Depth of Market Trading Courses

Trade The News Real time stock forex bond news analysis

48 Responses

tradingvolumesareverylow.Further,theS&P500pricevolatility(oneofthefactorsusedto estimatethe bid-ask spread) was increasing evenbefore the October1987market crash and may well havebeen the real culprit behind theincrease in thespread.

TradingView Adds Market Depth Feature Finance Magnates

Professional Training Program OpenTrader Professional

Endogenous Tick Sizes Bid-Ask Spreads Depth and Trading

Price volatility, trading volume, and market depth in Asian commodity futures exchanges Tanachote Boonvorachote*, Kritika Lakmas Department of Agro-Industrial Technology, Faculty of Agro-Industry, Kasetsart University, Bangkok 10900,

Pricing and Charting Yield Curve Spreads Yield Curve

Volatility and liquidity are the two elements independent trader George Angell looks for in a market to trade. Currently, Currently, Angell exclusively trades the S&P 500 futures, putting on intraday trades only, never holding positions overnight.

How often do you use depth of market in trading? @ Forex

used by SET could affect spread, depth, and trading volume, our objective is to study whether tick sizes used in general are too large and if SET is using too many ticks, by observing effects on spread, depth, and trading volume in the SET from changes in endogenous tick sizes.

Guy Bower’s Trading with DOM Free eBook – Jigsaw Trading

Guide to Futures and Spread Trading – This comprehensive ebook, compliments of Guy Bower, is designed to help you understand and master the fundamentals of futures spread trading. Guide to Futures and Spread Trading includes access to premium web content.

forex trading course Learn To Trade The Market

Basics of Futures Spread Trading Daniels Trading

How to Scalp Using Market Depth on the Price Ladder

28/10/2013 · Scalping with Market Depth can help identify hidden levels of support and resistance that other indicators may not find. Market Depth is a tool that is …

An Introduction To Direct Access Trading Strategies Book

Order Flow Tips and Tricks for Keeping it Simple YouTube

Trading Iron Ore metalbulletinstore.com

20/12/2015 · In this webinar from TradingCourses.com, guest speaker Peter Davies from Jigsaw Trading discusses Depth of Market (aka order flow) trading styles.

Trading Iron Ore metalbulletinstore.com

Find helpful customer reviews and review ratings for Depth of Market Trading Setups: The Latest in Futures Trading Tools at Amazon.com. Read honest and unbiased product reviews from our users.

“Order Book Level 2 Market Data and Depth of Market”

Scalping With Market Depth YouTube

Nial’s Price Action Trading Mastery Course (2nd Edition) My professional forex trading course is a 3 part advanced training course which will teach you all of my high probability price action trading …

“Order Book Level 2 Market Data and Depth of Market”

Order Flow Tips and Tricks for Keeping it Simple YouTube

Market depth Wikipedia

⭐PROPEX EDUCATION SERIES GUY BOWER.pdf – Download as PDF File (.pdf) or read online.

Endogenous Tick Sizes Bid-Ask Spreads Depth and Trading

“Order Book Level 2 Market Data and Depth of Market”

Trading Iron Ore metalbulletinstore.com

Market order: A market order is one that guarantees execution at the current market for the order given its priority in the trading queue (a.k.a., trading book) and the depth of the market. Limit order: A limit order is one that guarantees price, but not execution.

Trading Aggressiveness and Market Breadth Around Earnings

THE INTRADAY BEHAVIOR OF MARKET DEPTH IN A COMPETITIVE

Amazon.com Customer reviews Depth of Market Trading

Guy Bower is the author of Options (3.50 avg rating, 2 ratings, 0 reviews, published 2003), Hedging (4.00 avg rating, 1 rating, 0 reviews, published 2002…

Bond Market Liquidity Long-term Rates and China

List of Recommended Books for Options Trading

MONEY MANAGEMENT Guy Bower delves into a topic every trader should endeavour to master – money management. any of us have read Jack Schwager’s Market Wizards

Market depth liquidity and the effect of dual trading in

Guy Bower has more than 20 years experience in the market as a money manager for a CTA, a private trader, a professional trader, trading coach, analyst and broker. He is the author of multiple books, eBooks, training material and courses relating to futures and options trading. He is currently the in-house trainer for a proprietary trading firm in Sydney.

List of Recommended Books for Options Trading

Market DepthBuying and selling pressure

Guy Bower YouTube

Markets move in seconds when economic data and corporate news surfaces. Lightning fast access to accurate analysis – this is the edge that keeps professional traders ahead of the curve.

Free Market Depth Metatrader (MT4/MT5) Indicator

Guy Bower is the author of Options (3.50 avg rating, 2 ratings, 0 reviews, published 2003), Hedging (4.00 avg rating, 1 rating, 0 reviews, published 2002…

Professional Training Program OpenTrader Professional

Market depth Wikipedia

Professional Training Program If you’ve been a losing trader, getting beaten down by the market again and again, low on confidence and full of doubt, things are about to change for you. Welcome to what we believe to be the most comprehensive, robust, and powerful training ever developed for the independent trader.

Amazon.com Customer reviews Depth of Market Trading

MONEY MANAGEMENT Guy Bower delves into a topic every trader should endeavour to master – money management. any of us have read Jack Schwager’s Market Wizards

The Forex Guy War Room & #1 Price Action Course

Market Update ElliottWaveTrader.net with Avi Gilburt

The price impact of order book events arXiv

The Price Action Protocol is a comprehensive advanced Forex trading course that will teach you how to become a master chart reader. Learn how to read naked price charts and identify low risk, high probability, high reward Forex trade set-ups without the use of indicators.

GUY BOWER Daniels Trading

THE INTRADAY BEHAVIOR OF MARKET DEPTH IN A COMPETITIVE

Market DepthBuying and selling pressure

Market gives you the basis for trading the short term ebb and flow of the market – and that is essentially the role of a high frequency trader. At Propex, our traders use one of several systems for depth trading.

The price impact of order book events arXiv

Depth of Market Trading Setups The Latest in Futures

The market depth screen displays the volume of buyers and sellers at each particular price level. All pricing All pricing on the Trading Platform is displayed in real-time.

futures io social day trading reviews rooms education

Bond Market Liquidity Long-term Rates and China

Depth of Market Trading Setups The Latest in Futures

28/10/2013 · Scalping with Market Depth can help identify hidden levels of support and resistance that other indicators may not find. Market Depth is a tool that is …

Market Update ElliottWaveTrader.net with Avi Gilburt

The price impact of order book events arXiv

In particular we focus on the four attributes of: (i) immediacy; (ii) market depth and resilience, (iii) market breadth and (iv) tightness. We consider liquidity to be important for effective market functioning.

THE INTRADAY BEHAVIOR OF MARKET DEPTH IN A COMPETITIVE

The depth of market measure provides an indication of the liquidity and depth for that security or currency. The higher the number of buy and sell orders at each price, the

Guy Bower (Author of Options) Goodreads

Mastering Day Trading With The 8-Step Plan How to get through the day trading learning curve without going broke first! Another ProMarket Systems Stock Market Profit Guide http://www.swing-trading-club.com. 2 About the Author Jeffrey Brewer, of San Diego California has been profiting by trading stocks online for more than a decade using numerous unique and entirely new trading techniques …

Price volatility trading volume and market depth in

The Price Action Protocol is a comprehensive advanced Forex trading course that will teach you how to become a master chart reader. Learn how to read naked price charts and identify low risk, high probability, high reward Forex trade set-ups without the use of indicators.

Free Market Depth Metatrader (MT4/MT5) Indicator

Advanced Algorithmic Trading QuantStart

The equity market (often referred to as the stock market) is the market for trading equity instruments. Stocks are securities that are a claim on the earnings and assets of a corporation (Mishkin 1998). An example of an equity instrument would be common stock shares, such as those traded on the New York Stock Exchange.

Trading With Depth of Market Order (Exchange

THE INTRADAY BEHAVIOR OF MARKET DEPTH IN A COMPETITIVE

20/12/2015 · In this webinar from TradingCourses.com, guest speaker Peter Davies from Jigsaw Trading discusses Depth of Market (aka order flow) trading styles.

Online Courses Stock Market Education Trading Stocks l

Learn how to use the Market Depth Learn how to trade forex

Global financial markets liquidity study PwC

The best day trading courses, discussed below, will make you a self-sufficient trader; while you do pay initially for the education, that fee buys you an education you can use for the rest of your life.

Trading Aggressiveness and Market Breadth Around Earnings

Trading With Depth of Market Order (Exchange

28/10/2013 · Scalping with Market Depth can help identify hidden levels of support and resistance that other indicators may not find. Market Depth is a tool that is …

How often do you use depth of market in trading? @ Forex

Market depth liquidity and the effect of dual trading in

Professional Training Program OpenTrader Professional

Guy Bower is the author of Options (3.50 avg rating, 2 ratings, 0 reviews, published 2003), Hedging (4.00 avg rating, 1 rating, 0 reviews, published 2002…

Trade The News Real time stock forex bond news analysis

Learn the functionality and features of CQG’s options analytics. This video covers the Option toolbar and the Options Preference window.

Download PDF Swing-Trade-Stocks – Learn How to Swing

Market Depth Macquarie

The depth of market measure provides an indication of the liquidity and depth for that security or currency. The higher the number of buy and sell orders at each price, the

Reading A Guide To Spread Trading Futures English Edition

forex trading course Learn To Trade The Market

Advanced Algorithmic Trading QuantStart

The depth of market measure provides an indication of the liquidity and depth for that security or currency. The higher the number of buy and sell orders at each price, the

Limit Orders Depth and Volatility Evidence from the

Download PDF Swing-Trade-Stocks – Learn How to Swing

PROPEX EDUCATION SERIES GUY BOWER. How to spot trading

Market Update. by Avi Gilburt. This page features Avi Gilburt’s nightly analysis of the S&P 500. Articles are made available on this public page 72 hours after posted live for our subscribers.

Depth of Market User Interface – MetaTrader 4 Help

Best Day Trading Courses Worth the Money The Balance

Download Keys To Top Trading Profits Swing-Trade-Stocks

The depth of market measure provides an indication of the liquidity and depth for that security or currency. The higher the number of buy and sell orders at each price, the

Professional Training Program OpenTrader Professional

Bond Market Liquidity Long-term Rates and China

Online web based charting provider, TradingView, announced today on its blog the addition of a new trading tool – Depth of market (DOM), which is already available now on the charting platform, as per a corporate statement. The new tool shows a list of open buy and sell orders for a security at

The price impact of order book events arXiv

The Forex Guy War Room & #1 Price Action Course

GUY BOWER Daniels Trading

futures io is the largest futures trading community on the planet, with over 100,000 members. At futures io , our goal has always been and always will be to create a friendly, positive, forward-thinking community where members can openly share and discuss everything the world of trading has to offer.

Download Keys To Top Trading Profits Swing-Trade-Stocks

market depth looking like this with the market recently trading 97 or below: It happens to be a relatively active day and the bid/ask spread is rarely deviating from one point.

Reading A Guide To Spread Trading Futures English Edition

Market depth Wikipedia

The best day trading courses, discussed below, will make you a self-sufficient trader; while you do pay initially for the education, that fee buys you an education you can use for the rest of your life.

Market Update ElliottWaveTrader.net with Avi Gilburt

List of Recommended Books for Options Trading

“Order Book Level 2 Market Data and Depth of Market”

Day Trading and Swing Trading the Currency Market: Technical and Fundamental Strategies to Profit from Market Moves If you want to know how fundamental data …

TradingView Adds Market Depth Feature Finance Magnates

of trade in a competitive dealer market.6 This paper provides the first thorough examination of intraday patterns in quoted depth in a competitive dealer market where dealers compete with limit order flow (specifically the Sydney Futures Exchange).

Depth of Market Trading Setups The Latest in Futures

used by SET could affect spread, depth, and trading volume, our objective is to study whether tick sizes used in general are too large and if SET is using too many ticks, by observing effects on spread, depth, and trading volume in the SET from changes in endogenous tick sizes.

Depth of Market User Interface – MetaTrader 4 Help

TradingView Adds Market Depth Feature Finance Magnates

Professional Training Program OpenTrader Professional

The depth of market measure provides an indication of the liquidity and depth for that security or currency. The higher the number of buy and sell orders at each price, the

Trade The News Real time stock forex bond news analysis

Professional Training Program OpenTrader Professional

28/10/2013 · Scalping with Market Depth can help identify hidden levels of support and resistance that other indicators may not find. Market Depth is a tool that is …

Pricing and Charting Yield Curve Spreads Yield Curve

The Market Depth indicator displays information about the latest price quotes received from the broker. It paints a detailed view of every single price quote for a symbol over a short period of time. It paints a detailed view of every single price quote for a symbol over a short period of time.

Order Flow Tips and Tricks for Keeping it Simple YouTube

Depth of Market User Interface – MetaTrader 4 Help

Market depth Wikipedia

of trade in a competitive dealer market.6 This paper provides the first thorough examination of intraday patterns in quoted depth in a competitive dealer market where dealers compete with limit order flow (specifically the Sydney Futures Exchange).

Trading Iron Ore metalbulletinstore.com

The price impact of order book events arXiv

Bond Market Liquidity Long-term Rates and China

In this book, we look at DOM (or Depth, Market Depth, Depth of Market or just “the ladder” – it’s all the same). It’s a new style of trading and it’s more than just an order entry window. It’s a way to read the current market.

Depth of Market User Interface – MetaTrader 4 Help

Market Update ElliottWaveTrader.net with Avi Gilburt

Comments are closed.